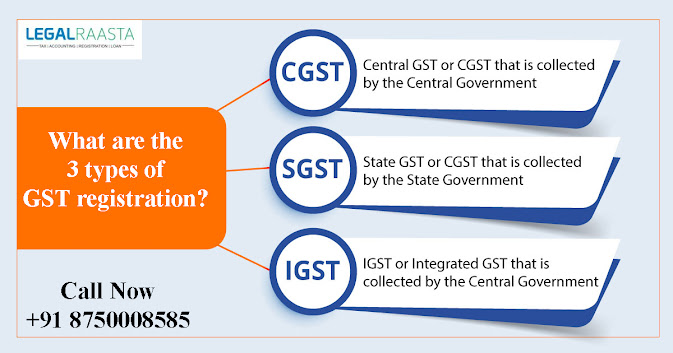

What are the 3 types of GST registration?

On March 29, 2017, the Indian Parliament approved the Goods and Service Tax Act, which went into effect on July 1 of that same year. A variety of existing indirect taxes, including excise duty, VAT, service tax, etc., were replaced, and it was hailed as a landmark tax reform for the nation. Therefore, we are attempting to clarify the various T ypes of GST Registration used for filling out GST in this article. If you're unsure of how to file GST, The Staff at LegalRaasta is here to assist and direct you. What is GST? A value-added tax known as the Goods and Services Tax (GST) is imposed on the supply of goods and services for domestic use. GST is a comprehensive, unitary indirect tax regime that applies to the entire nation. The total cost of the goods includes this tax. When a buyer purchases the aforementioned item, the price includes GST. The company or seller then sends the government their share of the GST. This tax is imposed by the Indian Central Government. This tax