What are the 3 types of GST registration?

On March 29, 2017, the Indian Parliament approved the

Goods and Service Tax Act, which went into effect on July 1 of that same year.

A variety of existing indirect taxes, including excise duty, VAT, service tax,

etc., were replaced, and it was hailed as a landmark tax reform for the nation.

Therefore, we are attempting to clarify the various Types of GST Registration used for filling out GST in this article.

If you're unsure of how to file GST, The Staff at LegalRaasta is here to assist and direct you.

What is GST?

A value-added tax known as the Goods and Services Tax

(GST) is imposed on the supply of goods and services for domestic use. GST is a

comprehensive, unitary indirect tax regime that applies to the entire nation.

The total cost of the goods includes this tax. When a buyer purchases the

aforementioned item, the price includes GST. The company or seller then sends

the government their share of the GST. This tax is imposed by the Indian

Central Government. This tax is split between the federal and state governments

under CGST and SGST for GST filing

in the case of intra-state transactions.

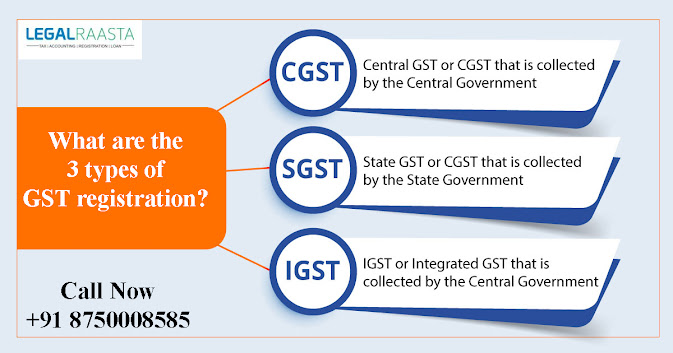

Various Types of GST Registration

The GST system considers the following

transaction types, based on which the appropriate tax amount is assessed:

Ø Inter-State

transactions: It is an exchange of money between two

states. For instance, an iron ore supplier in Jharkhand sends gold ore to a

customer in West Bengal. The Central government and the West Bengal government,

or the State of consumption, split the GST that was thusly collected.

Ø Intra-State

transactions: An intra-state transaction is one that takes

place inside of a State. As an illustration, a company in Jharkhand sells 1

tonne of gold ore to a client inside the State. The Centre government and the

Jharkhand government receive the GST after that. Due to the nature of these

transactions, three separate types of GST

Registration—State Goods and Services Tax, Central Goods and Services Tax,

and Integrated Goods and Services Tax—are typically employed.

The following are some of the intra-state

transaction GST registration components:

Ø SGST: The

intrastate exchange of goods and services is subject to SGST by the state

government. The state government in which this transaction occurs receives the

money collected. The SGST replaces former taxes as the VAT, Octroi, purchase

tax, luxury tax, etc. A Union Territory Goods and Services Tax, or UGST,

substitutes the SGST for union territories like Chandigarh, Puducherry, and the

Andaman and Nicobar Islands.

Ø CGST: The

central government assesses CGST on the exchange of goods and services within a

state. The collected funds are split equally between the center and the state

and are charged alongside SGST or UGST.

Ø IGST: An IGST is assessed

when a transaction involving goods and services is intra-state in character.

Both imports and exports are covered by it. The state and the federal

governments split the tax's revenue in order to file GST returns.

How is GST calculated?

Ø The location of the

vendor and the buyer of the goods and services is used to calculate the GST.

Ø The intrastate supply

of goods and services is subject to the CGST and SGST. In contrast, for the

purposes of GST filing, IGST is

applicable to interstate supply of goods and services.

Ø The CGST and SGST

rates are thus combined to create the IGST rate.

Objectives of filing a GST

Ø The repeal of other

taxes:

Other indirect taxes were replaced by the GST Act when it was enacted. The GST

combines the principal taxes.

Ø Improves compatibility: MSMEs and small

enterprises have it easier to comply with tax laws. Additionally, the existence

of a single tax simplifies the return-filing procedure.

Ø Increases

transparency: The GST increases transparency while lowering the likelihood of

corruption. For instance, there are less opportunities for bogus input tax

credits in enterprises.

Ø Price reduction: By abolishing the

previous tax-on-tax system and taxing only the net value-added portion, the GST

law lowers the price of goods.

Ø Boost the nation's

revenue: A high tax-to-GDP ratio reveals rising government revenues, which

denotes a robust economy. A wider tax base and more tax compliance can also

result in an increase in the amount of money the government receives from GST

operations.

Ø High productivity and

efficiency: The GST in India aims to do away with administrative hurdles and the

time-consuming input tax credit reporting process. In addition, it is

anticipated that abolishing the entry tax will increase business productivity.

Characteristics of GST Registration

Ø Under the GST Act,

each firm that registers for the GST is given a Goods and Services Tax

Identification Number (GSTIN) or GST Number. The GST officers can maintain

track of GST transactions and dues with the use of this GSTIN.

Ø It is prohibited for

any company or organization to operate without first registering for GST.

Submissions of incomplete GST Returns result in the denial of the input tax

credit and the enforcement of penalty. The GSTIN essentially serves as a seal

of approval. It helps customers, e-commerce platforms, public tenders,

financial firms, corporations, and others recognize your brand.

.jpg)

Comments

Post a Comment